RESERVE STUDIES

Long range funding for capital repairs, replacements, and reserves has become increasingly important for maintaining and enhancing the values of facilities for the benefit of owners, buyers, users, lenders, and insurance carriers.

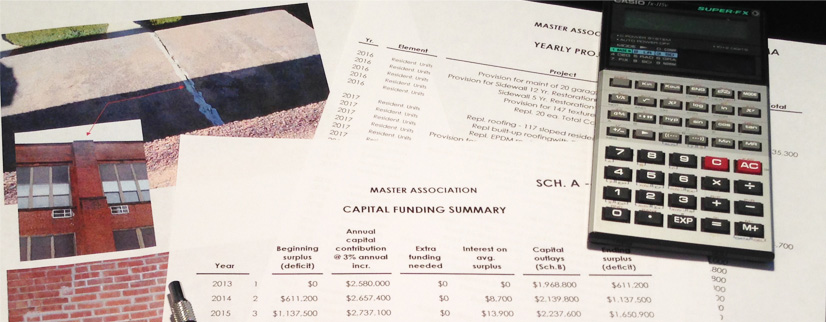

Our approach to reserve studies and capital needs assessments consists of accumulating site data and condition assessments of the facility elements, preparing a comprehensive report, and making formal presentations of our findings and recommendations to interested parties.

The assessment provides a straightforward and flexible cash flow model to help make informed decisions rather than knee–jerk responses to failed or deteriorated conditions. It is also useful for evaluating the financial impact of major projects and alternative funding strategies. The assessment serves as an effective tool for evaluating capital reserve funding strategies in view of changing circumstances, such as the impact of volatile oil prices, construction material prices, and inflation. For homeowners associations with common interests, this assessment demonstrates to owners that they are being asked to pay neither too much nor too little in maintenance fees for the future.

Our analysis evaluates current reserve funding policies, incorporates priorities of the management, and provides guidelines for the future management of the facility. We utilize common business software, making future updates very easy to accomplish.